$DNOPY - Investment Thoughts

The worst case scenario does not look so bad

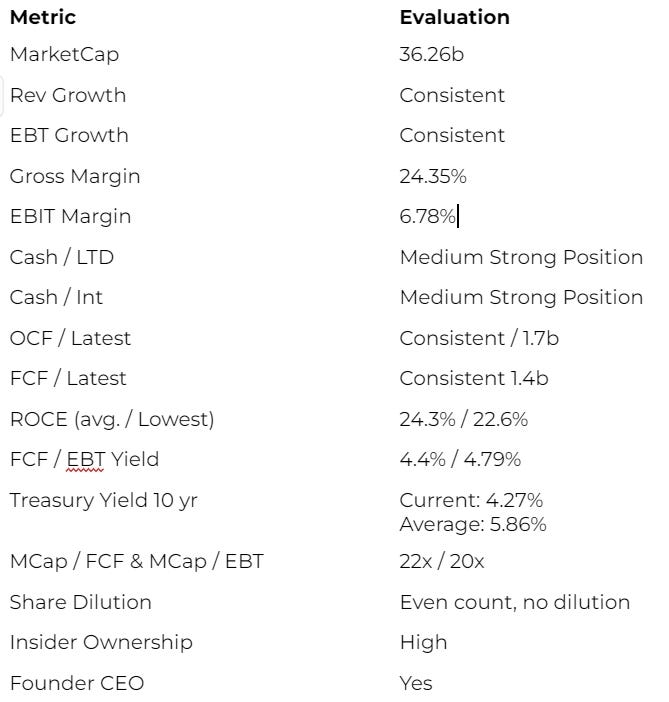

Valuation Data

All numbers are based on 5 year averages unless otherwise noted

Quick Valuations

Pabrai: 10 x FCF + Cash = 15.69b

Pabrai: 15 x FCF + Cash = 23.94b

DCF: 38.38b (1.569b, ROCE: 22.6%, 5.86 discount rate)

ROCE Analysis

How much FCF is generated on Capital

The company is producing a 24.3% ROCE on average since their IPO. The lowest ROCE during the period of the last 5 years was 22.6%, which is a small deviation from the average. The ROCE has been growing slowly from 22.6% to 26.7% as of the 2023 annual report.

The company has steady and consistent Gross Margins between 23.08% and 25.7% for the last 6 years. The trend for the last 3 years is decreasing due to inflation. The EBT margins are between 5.2% and 7.9% with 5.3% being a one time outlier.

The numbers and the reading of all annual reports show a company that is executing on a growth strategy consistently and without hiccups. The individual grocery stores seem to be run well providing consistent cash flow. There aren’t many fluctuations. Many reports, articles and cloners seem to agree that the company is solid.

Reinvesting / Buybacks Analysis

Can the FCF be reinvested at the same rates of return

The company is reinvesting all of their free cash flow into growth. This is the ideal flywheel that I want to see. They do not pay a dividend, they do not dilute the shares and in the future when growth slows, stores get mature, they can buy back shares. Which they are likely to do, because of the high ownership of the Founder CEO. The company has announced that they are slowing the pace of growth due to macro trends. If that is true and not a lie, then the market will possibly offer us this Gem at a discount a few times this year.

Growth Analysis

Can the company continue to grow for 5 to 10 years

I believe the company can continue to grow. Their target market of smaller communities in Poland is by no means tapped out. In terms of their TAM, an analysis (Substack@CompoundQuality; and investor presentation linked below) I read believes that 11,000 stores is a realistic target inside Poland, not including international expansion. Currently the company has 2,340 stores.

FCF / Store = $670,628

FCF at TAM = ~$6.7 billion in free cash flow

This would imply a value of over 67 billion, which it currently sells at ~50% at. But this assumes everything will go well. But even if only 50% of that is achieved then the company is worth 37b and is currently available at a small discount to that. This also does not take into account the maturing of the stores, the improving of margins, international expansion options and small investment opportunities paying off and scaling.

Moat Analysis

Invert: What can kill the company?

What if customers' wants and needs from cheaper goods change because inflation stops, or something causes preferences to change?

If inflation goes down and subsides, customers will have more spending power. They can again go to other stores where the prices are higher. They can shift their spending habits back to some more luxury items they will not get from Dino. The main argument as to why that risk is not that big of a deal is that Dino also had the same growth rate prior to 2022 and prior to 2020. So far the stores seemed to attract customers regardless of inflation and war.

Increasing inflation increases Dino costs, so decreasing inflation likely would decrease costs, improving margins and possibly even offset the effects of customer attrition. The question then becomes how much does the convenience of location and the ease of shopping at a Dino store outweigh the available spending power? I would say that the general daily shopping needs are not impacted and customers may wander to another store on weekends when they are further away from home anyway.

Interest Rates

I don't see interest rates as an issue. The company has little debt, and finances itself out of FCF. Interest rate increases may make the purchasing of the real estate more expensive to finance, but again that is not a big concern for Dino. If interest rates are lowered (Switzerland just did), then the financing costs would decrease and that would actually in theory benefit Dino. I think Dino is interest rate agnostic at least within the 2 to 4% range.

Customers in Poland would also not be affected one way or the other. The main customer of Dino is rural, likes to walk, they don't own cars and generally have much debt. Home loans may be affected depending on the fixed vs floating rate financing, but hey, everyone has to eat and Dino is the cheaper option already.

What happens if NATO and Russia go to war?

This is the biggest risk in my opinion. If Russia invades Poland, our investment has a problem. In this case I would likely immediately sell. However, if Russia does attack NATO I think investment money is no longer the main concern for me. Leaving Europe, going to South America, protecting the family, having cash would all become more critical. But yes, if this were to happen, I would immediately sell the position.

Can the larger competitors adjust their store format?

Not easily. When a system is in place that produces billions in revenue, shifting gears is difficult. They have contracts, agreements, logistics, partnerships with distributors who they cannot just abandon. There are many factors involved in shifting gears like that. It is of course possible, but I think the cultural aspect of Polish country dwellers shopping in a Polish store, with Polish foods run by polish management is likely to prevail over an Aldi coming in and pushing their model. Aldi may be successful in some areas, but their concept is a different one and they are doing something different.

Liquidity risk by buying the OTC vs the DNP stock on the polish exchange

This is a valid point and one to consider. If there were international tensions and conflicts selling quickly would be crucial.

Real Estate Market Downturn?

Dino owns all its own land and real estate. Most of it is in rural areas where the prices of real estate are by nature not as high as in cities and urban areas. A real estate downturn would cause the property values of Dino to shrink and therefore the balance sheet to be affected. But, on the other hand it would also enable them to buy future properties and land at cheaper prices. This risk comes down to how prudent management will be in allocating capital and based on their track record they are very good at it.

Slowing Store Opening Rates

This is also a risk. At the moment everyone's thesis revolves around continuing growth at a pace even to or slightly less than the historic rate. My calculation at the lowest end was 22.6% ROCE. This apart from a russian war is the largest risk that I am concerned about. What if there is something everyone overlooks that causes the rate of growth to slow down drastically?

I believe the probability of that happening is lower than the probability of growth continuing in some form. Dino is going to open more stores, but possibly at a lower rate, or with less intensity as before. Worst case the company would hold on to their stores and produce annual cash flow, which they could use to improve margins (which they are doing), make small investments into expanding their offerings (which they are doing) and I would be holding a company more like an annuity.

Margin of Safety

What is the margin of safety if the worst case occurs?

Dino made 1.7b in EBT last year. Without growth and stores maturing, this will increase into a bit more than 2b in 3 years. This would imply a valuation of 20b to 25b at Pabrais quick 10x system. Currently we can buy the company for 35b, which implies slower growth. I would say we have a margin of safety at the current level, if we assume some growth will continue.

Good companies are seldomly offered cheaply and how much cheaper it will get is difficult to say. It may never be cheap, it may get cheaper.

Some References:

https://seekingalpha.com/article/4674698-dino-polska-disrupting-growth-in-poland

https://seekingalpha.com/article/4594199-dino-polska-the-future-polish-king-of-supermarkets

https://substack.com/@compoundingquality

many more if you search a bit